Coase on Property and Social Cost#

Some simple examples to illustrate Coase’s ideas on property rights and social cost and the role of firms. Based on two classic papers:

Coase, R. H. 1960. “The Problem of Social Cost.” The Journal of Law and Economics 3:1–44.

Coase, Ronald H. 1937. “The Nature of the Firm.” Economica 4 (16):386–405.

Slideshow mode: this notebook can be viewed as a slideshow by pressing Alt-R if run on a server.

The assignment of property rights (liability)#

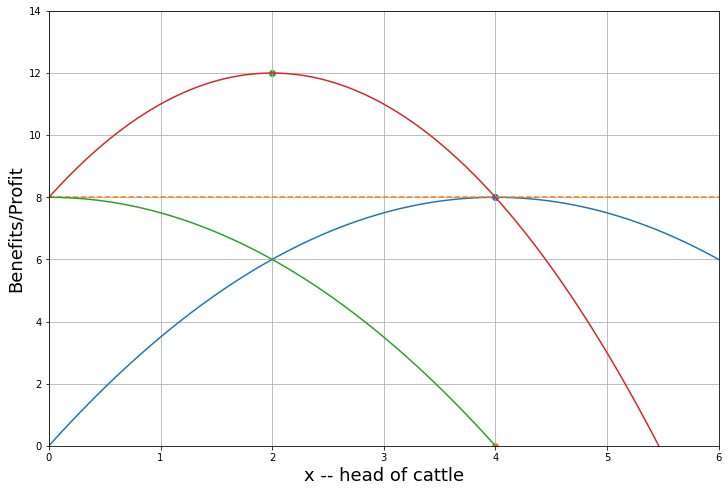

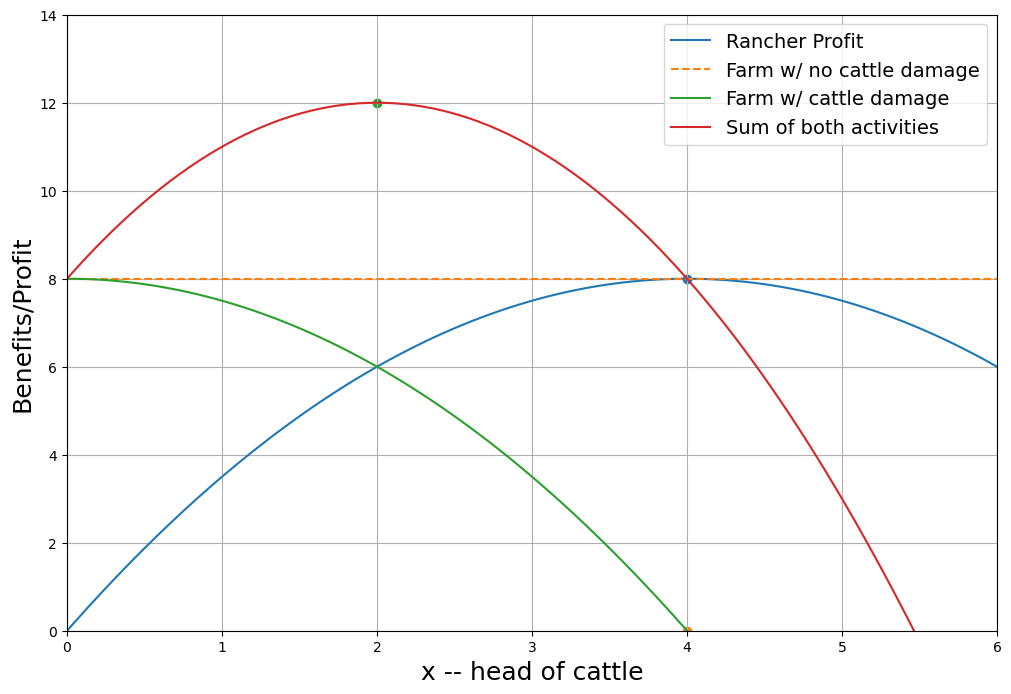

Scenario 1: Farmer is given the right to enjoin (i.e. limit or prohibit) cattle herding.

If the farmer enforces a prohibition on all cattle herding:

Rancher now earns $0.

Farmer earns $8.

But this is not efficient! Total output is smaller than it could be.

If transactions costs are low the two parties might bargain to a more efficient outcome.

A possible deal: the Rancher could reasons that if she were permitted to herd 2 cattle she’d earn \(\$6\) while imposing $2 in damage.

She could offer \(\$2\) in full compensation for the damage, pocketing remaining $4

or they could bargain over how to divide the gains to trade of $4 in other ways.

Scenario 2: (different assignment of rights). Rancher is granted right to graze with impunity.

A possible deal: Farmer reasons that if herd size were reduced from 4 to 2

farm profits would rise from \(\$0\) to \(\$6\)

rancher’s profits would fall from \(\$8\) to \(\$6\)

So farmer could offer to fully compensate rancher for \(\$2\) loss and pocket remaining \(\$4\)

or they could bargain to divide those gains to trade of \(\$4\) in other ways.

Who causes the externality?#

The rancher, because his cows trample the crops?

The farmer, for placing his field too close to the rancher?

Ronald Coase point is that there is no clear answer to questions like this.

Hence Pigouvian tax/subsidy ‘solutions’ are not obvious. Should we tax the rancher, or subsidize them to keep their herd size down?

The ‘externality’ problem is due to the non-assignment of property rights.

The ‘Coase Theorem’#

With zero/low transactions costs#

The initial assignment of property rights does not matter for efficiency: In both scenarios above the parties traded to an efficient solution no matter who held the initial assignment of rights.

The initial allocation does, however, matter for the distribution of benefits between parties. Legally tradable entitlements are valuable, they generate income to those who can then sell.

The ‘emergence’ of property rights: One might argue that even with no initial third-party assignment of property rights, it should be in the interests of the parties to create such rights and negotiate/trade to an efficient outcome. There are ‘Coasian’ gains to creating property rights.

This way of thinking is consistent with a market-friendly view that efficiency is matter or removing impediments to free exchange of legal entitlements (e.g. “getting the government out of the way”, or involved in public policy efforts to assign and enforce property rights).

Coase Theorem: True, False or Tautology?#

“Costless bargaining is efficient tautologically; if I assume people can agree on socially efficient bargains, then of course they will… In the absence of property rights, a bargain establishes a contract between parties with novel rights that needn’t exist ex-ante.” Cooter (1990)

In the Farmer and Rancher example there was a missing market for legal entitlements. Once the market is made complete (by an assumed third party) then the First Welfare Theorem applies: complete competitive markets will lead to efficient allocations, regardless of initial allocation of property rights.

The “Coase Theorem” makes legal entitlements tradable by assumption.

Ronald Coase himself was quite clear that transaction costs are usually non-zero. As D. McCloskey explains:

“The interesting case is when transaction costs make bargaining difficult. What you should take from Coase is that social efficiency can be enhanced by institutions (including the firm!) which allow socially efficient bargains to be reached by removing restrictive transaction costs, and particularly that the assignment of property rights to different parties can either help or hinder those institutions.”

Coase’s (1937) paper on “The Nature of the Firm” argues that firms are organizations that reduce transaction costs by internalizing transactions that would be too costly to negotiate in the marketplace.

Good further discussions from D. Mcloskey and here:

When initial rights allocations matters for efficiency#

‘Coase Theorem’ (Stigler) interpretation sweeps under the rug the complicated political question of who gets initial rights.

Parties may engage in costly conflict, expend real resources to try to establish control over initial allocation of rights.

The Myerson Satterthaite theorem establishes that when parties are asymmetrically informed about each other’s valuations (e.g. here about the value of damages or benefits) then efficient exchange may become difficult/impossible. Each party may try to extract rents by trying to “hold-up” the other.

Suppose we had many farmers and ranchers. It might be costly/difficult to bring all relevant ranchers and farmers together and to agree on bargain terms.

Coase himself thought transactions costs mattered and hence initial allocation mechanisms had to be thought through carefully (e.g. spectrum auctions).

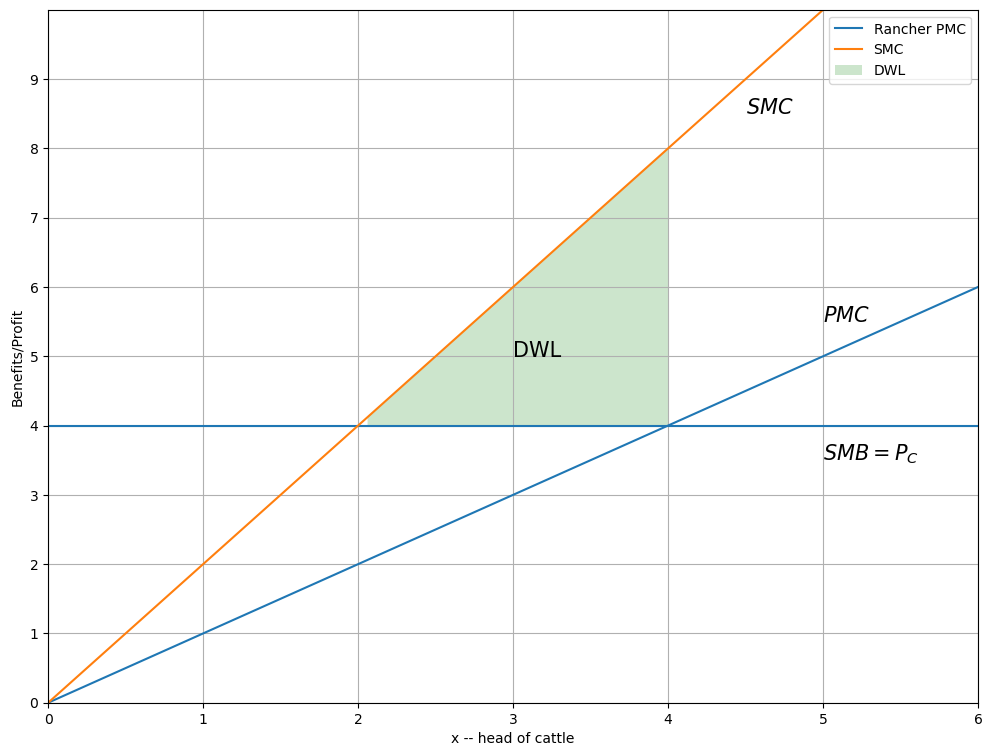

A Coasian view of land market development#

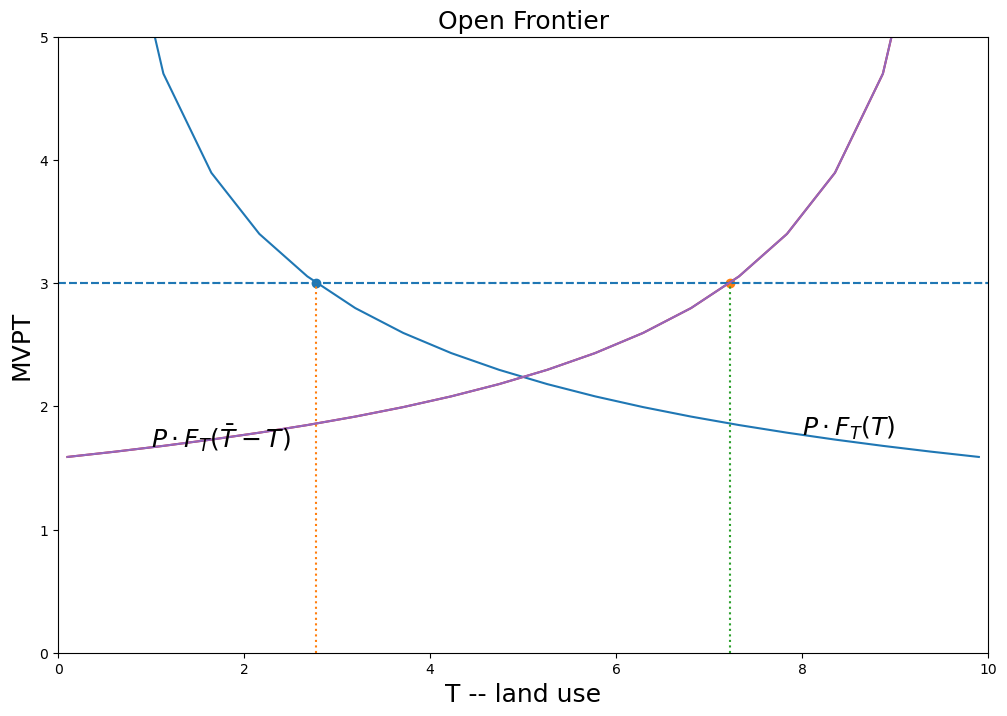

Suppose there is an open field. In the absence of a land market whoever gets to the land first (possibly the more powerful in the the village) will prepare/clear land until the marginal value product of the last unit of land is equal to the clearing cost. We contrast two situations:

(1) Open frontier: where land is still abundant

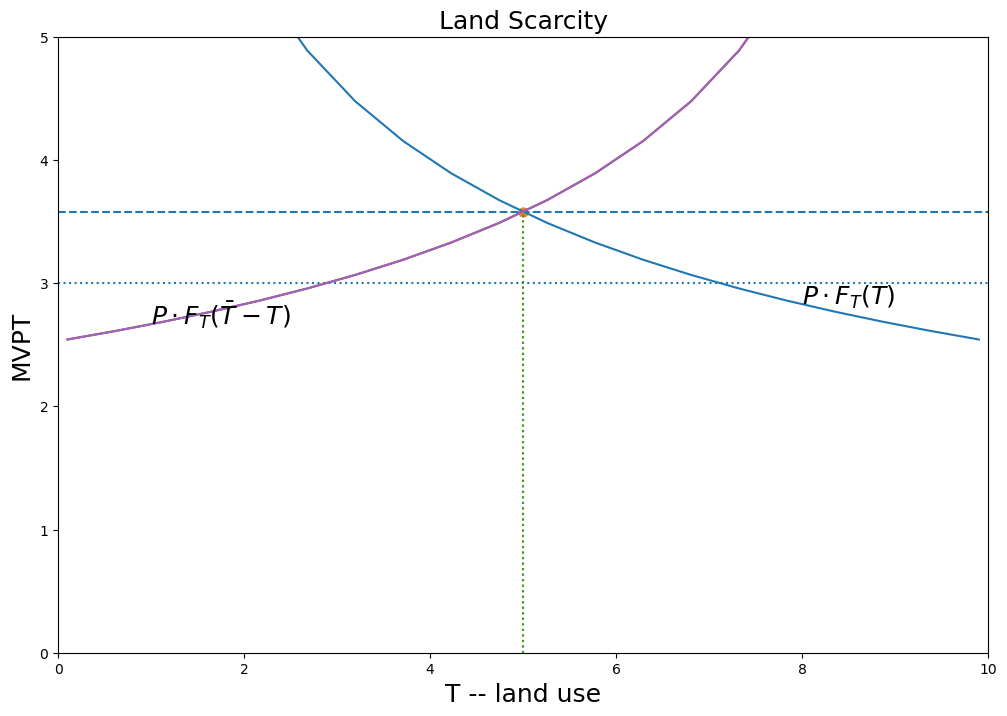

(2) Land Scarcity.

There will be a misallocation in (2) shown by DWL in the diagram… but also an incentive for the parties to bargain to a more efficient outcome. A well functionining land market would also deliver that outcome.

Abundant land environment#

\(\bar T\) units of land and \(N\)=2 households.

Land clearing cost \(c\). Frontier land not yet exhausted.

Maximize profits at \(P \cdot F_T(T) = c\)

Land demand for each farmer is given by \(P\cdot F_T(T_i) = r\). So for this production \(P \frac{1}{\sqrt T_i} = r\) or \(P \frac{1}{\sqrt T_i} = cl\) so we can write

If there is an open frontier the sum or demands falls short of total land supply and the marginal cost of land is the cost of clearing \(r=c_l\).

‘Land scarcity’ results on the other hand when there is an equilibrium price of land \(r>c_l\) where \(r\) is found from

Now land rent \(r-c\) can be charged on the right to access and use land. Trade in these legal entitlements can raise output and efficiency. But there may be conflict and a ‘scramble’ to establish those rights of first access.

‘Customary’ land rights#

Suppose norm is that all in the village can use as much land as they can farm

Higher status individuals get allocation first

As long as land is abundant everyone gets the land they want

No “land rent” – cannot charge rent above \(c\) since villagers are free to clear at cost \(c\)

landmarket(P=5, cl = 3, title = 'Open Frontier')

The closing of the frontier#

Rising population or improving price or technology increases demand for land.

Suppose price at which product can be sold increases

demand for land increases.

Suppose total demandat clearing cost \(c\) exceedsavailable land supply.

High-status individuals (who have first-access) leave less land available than is needed to satisfy remaining villagers demand.

Inefficient allocation of land

marginal products of land not equalized across households.

output would increase if we establish a market for trading land

landmarket(P=8, cl = 3, title = 'Land Scarcity')

We can solve for the equilibrium rental rate \(r\) given environmental paramters including the price \(P\), land endowment \(\bar T\), population size \(N\) and technology parameters $A)

interact(landmarket, P=(4,10,0.2), cl = (0,5,0.5),

title = fixed('Land'), A=fixed(1));

To do: (things to still do in this notebook)

indicate DWL on landmarket diagrams

create widget to see how diagram shifts with changing parameters