Threats to Commitment#

Appendix and replication code for:

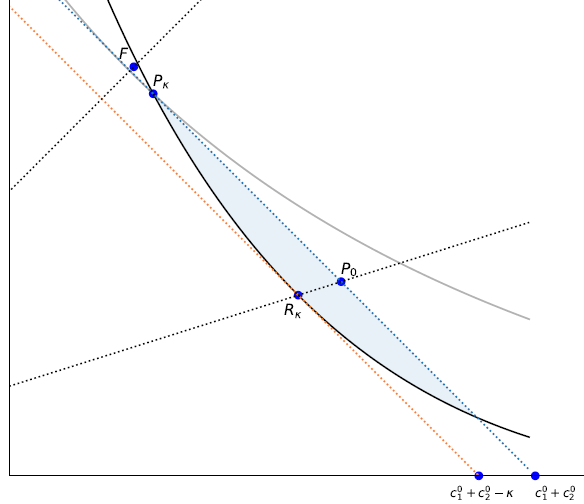

Basu, Karna and Jonathan Conning (2021) Threats to Commitment: Contracting with Present-Biased Consumers under Renegotiation Concerns, manuscript. Abstract: Hyperbolic discounters value consumption-smoothing commitment contracts, but may fear that these could be renegotiated by future selves and banks. This creates a consumer protection problem even for sophisticated and informed consumers. This paper studies how the threat of renegotiation affects equilibrium commitment contracts and bank governance forms. We find that familiar behaviors such as ‘over’-borrowing or ‘under’-saving emerge, but here as strategic partial concessions to future selves to avoid even costlier renegotiation behaviors later. We then show how it may be to banks’ advantage to offer additional consumer protection either via an appeal for government regulation or through costly private governance/ownership choices. By restricting their own ability to profit from opportunistic renegotiation, banks can expand gains to trade and captured profits. The framework establishes new behavioral micro-foundations for a theory of commercial non-profits and helps explain historical patterns of contracting and ownership forms in consumer banking and microfinance, and how these co-evolved with market structure.

Follow the links in the navigation bar at left to interactive notebooks that replicate the figures and allow changes to parameter values. All code is in Contract.py with additional detail and usage demonstrated in the notebooks.