Here is a presentation and simulation of a model of “Increasing Returns to Scale, monopolistic competition and Trade” based on the Krugman (1979) article by the same name in the Journal of International Economics with the following simplifications and adaptations:

model and graph analysis simplified to be similar to Krugman, Obstfeld, Melitz textbook.

We use the linear demand setup from Salop, S. (1979) “Monopolistic Competition with Outside Goods,” Bell Journal of Economics

This is a Jupyter notebook with executable Python code for the graphs and simulations. If you want to execute and interact with the content, scroll down to the code cells and run them sequentially.

Its associated inverse demand function will be:

Total Revenue can be differentiated to find

and we can find an expression for the gap

This is also the firm’s markup over marginal cost (since ).

Note the larger is , the more firm sales fall for a given price rise (i.e. the more elastic is demand).

Firm Technology and Costs¶

Each firm has exclusive right to produce a unique product (protected by patent or copyright) but competitors can enter the market to supply similar goods. There is a relatively high fixed cost of establishing a production plant and then a simple constant marginal cost:

hence and average cost is

Demand for Product Variety¶

Consumers demand variety. Products are symmetric substitutes in consumption. Salop (1979) constructs a model with linear demands

Assume symmetric demand for each good. Demand for firm ’s good is:

Here is total output in the industry. If firm sets product price equal to price of other similar products then firm will produce of total output. If it tries to raise it loses some but not all market share.

Expanding out the earlier inverse demand equation:

which we can invert to get an inverse demand curve for each firm.

Monopolistically competitive market with free entry will drive and hence profits to zero.

Source

import numpy as np

import matplotlib.pyplot as plt

from ipywidgets import interact, fixedSource

plt.style.use('seaborn-v0_8-colorblind')

plt.rcParams["figure.figsize"] = [6,6]

plt.rcParams["axes.spines.right"] = False

plt.rcParams["axes.spines.top"] = False

plt.rcParams["font.size"] = 18

plt.rcParams['figure.figsize'] = (10, 6)

plt.rcParams['axes.grid']=FalseA = 100000

b = 1/1000

F = 100*1000

c = 30

S = 1*1000*1000

qmax = 100

nmax = 50

q = np.arange(1,qmax)

n = np.arange(1,nmax)Source

def p(q, A=A, b = b):

return A/b - (1/b) * q

def mr(q, A=A, b = b):

return A/b - (2/b) * q

def AC(q, F=F, c = c):

return F/q + c

def mc(q, c = c):

return c*np.ones(len(q))

def cc(n, S=S, F=F, c = c):

return n*F/S + c

def pp(n, b=b, c = c):

return c + 1/(b*n)Source

def firm(S =S, F=F, c=c):

qmax = 15000

ne = np.sqrt(S/(b*F))

Pe = c + np.sqrt(F/(S*b))

qe = S/ne

q = np.arange(1,qmax)

plt.xlim(0,12000)

plt.ylim(0,125)

plt.plot(q, p(q, A=(S/ne+b*S*Pe), b = b*S))

plt.plot(q, mr(q, A, b), color='b')

plt.plot(q, mc(q, c))

plt.xlabel('q')

plt.ylabel('P, AC')

plt.plot(q, AC(q, F, c))

plt.scatter(qe,AC(qe,F,c))

plt.vlines(qe,0,Pe, linestyle=":")

plt.hlines(Pe,0,qe, linestyle=":");The following shows a firm in a long-run equilibrium where . The curve is not drawn, but it would cross the horizontal marginal cost curve to determine the equilibrium quantity.

firm(S=S/20, F=F, c=c)

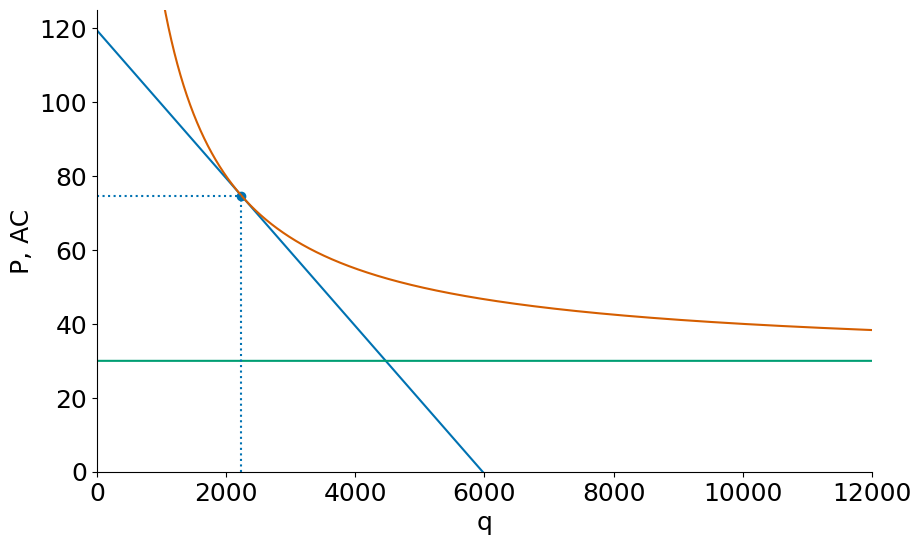

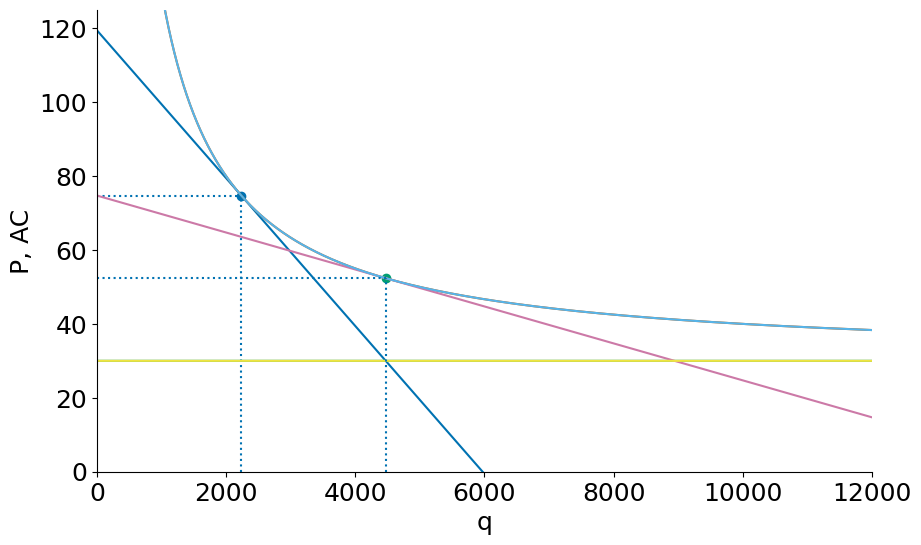

Below we can see the effect of increasing market size. As market size increases from to , the demand curve for each firm shifts out and becomes more elastic (flatter). However, any temporary new profits earned will attract new entrants, and we end up at a new equilibrium with a new further down the firm’s curve, as shown.

Hence, closed economy countries with larger market size will have more firms/product variety, lower equilibrium prices, and higher labor productivity (since each firm is further down its average cost curve).

firm(S=50000, F=F, c=c)

firm(S=200000, F=F, c=c)

Solving for equilibrium and ¶

In a symmetric equilibrium then or

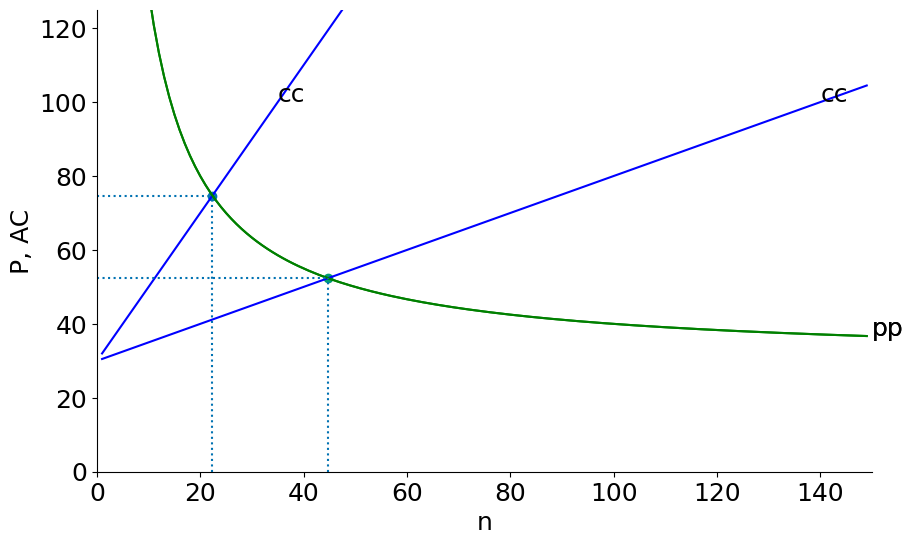

The cc curve¶

Average cost rises with the number of firms , because more firms in the same market means lower production runs and higher average fixed costs.

Substituting into :

Average cost rises with the number of firms because each firm produces less and so each firm is spreading their fixed costs over fewer units of output.

The pp curve¶

Price falls with the number of firms because increased competition reduces markups.

In a symmetric equilibrium firm demand could be written:

Source

def mkt_eq(S = S, F=F, c=c):

nmax = 150

n = np.arange(1,nmax)

ne = np.sqrt(S/(b*F))

Pe = c + np.sqrt(F/(S*b))

AC = c + ne*F/S

print(f"n = {ne:2.0f}, P={Pe:3.0f}, q = {S/ne:5.0f}, F/q = {ne*F/S:3.0f}")

plt.xlim(0,150)

plt.ylim(0,125)

plt.xlabel('n')

plt.ylabel('P, AC')

plt.plot(n, cc(n, S=S, F=F, c = c), color='b')

plt.plot(n, pp(n, b=b, c = c), color='g')

plt.text(nmax,pp(nmax),"pp")

ntop = (100-c)*S/F

plt.text(min(nmax,ntop), cc(min(ntop,nmax),S=S, F=F, c = c), "cc")

plt.scatter(ne,Pe)

plt.hlines(Pe,0,ne,linestyle=":")

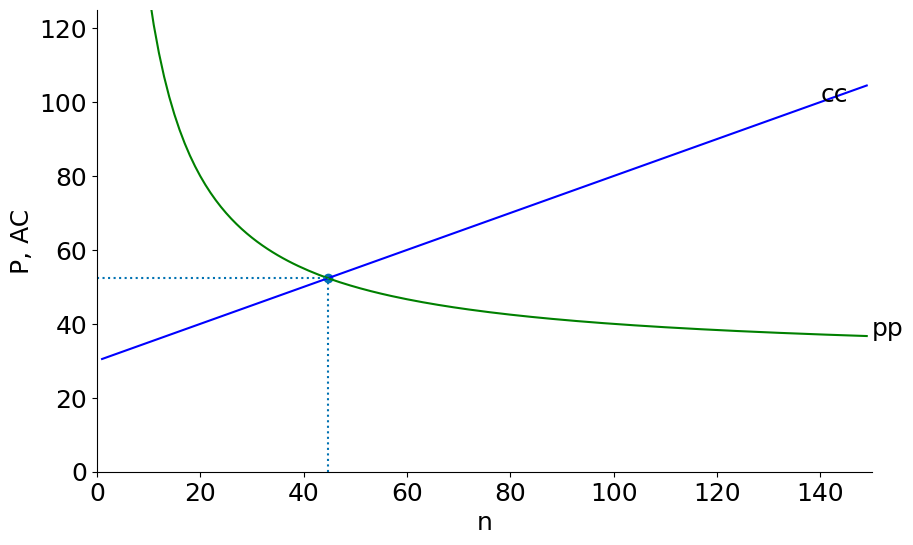

plt.vlines(ne,0,Pe,linestyle=":")mkt_eq(S=200000, F=F, c=c)n = 45, P= 52, q = 4472, F/q = 22

Here we can see the effect of opening to trade (the potential market for each firm now becomes the sum of the country markets ). Here we suppose four equal-size countries open up to each other (the graph then becomes a depiction of the integrated world market).

The result is lower prices and average cost and a higher number of product varieties .

mkt_eq(S=50000, F=F, c=c)

mkt_eq(S=200000, F=F, c=c)n = 22, P= 75, q = 2236, F/q = 45

n = 45, P= 52, q = 4472, F/q = 22

In the example above each country now sells to the entire world market, so the size of each country’s market in effect quadruples. The total number of firms (and products) goes from in each country (88 firms in total, but only 22 products) to a world total of firms and products. Each country now has just 11 firms but each of these firms now has much larger production runs ( after opening to trade compared to in the closed economy).

The price (and average cost) of each product falls from 52 and the number of product varieties rises from 22 to 45.

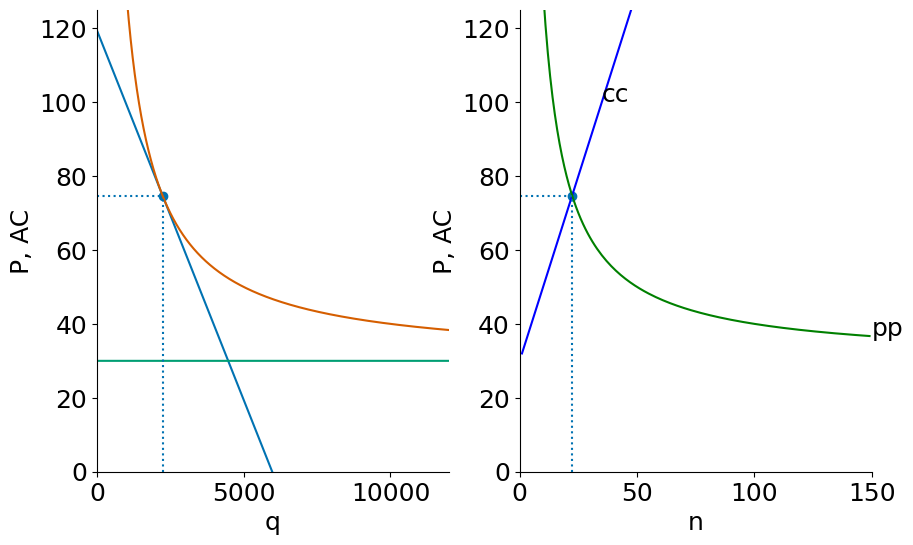

Below, we put the firm-level and market-level graphs side-by-side.

Source

def twopane(S, F, c):

plt.figure()

ax = plt.subplot(121)

firm(S,F,c)

ax= plt.subplot(122)

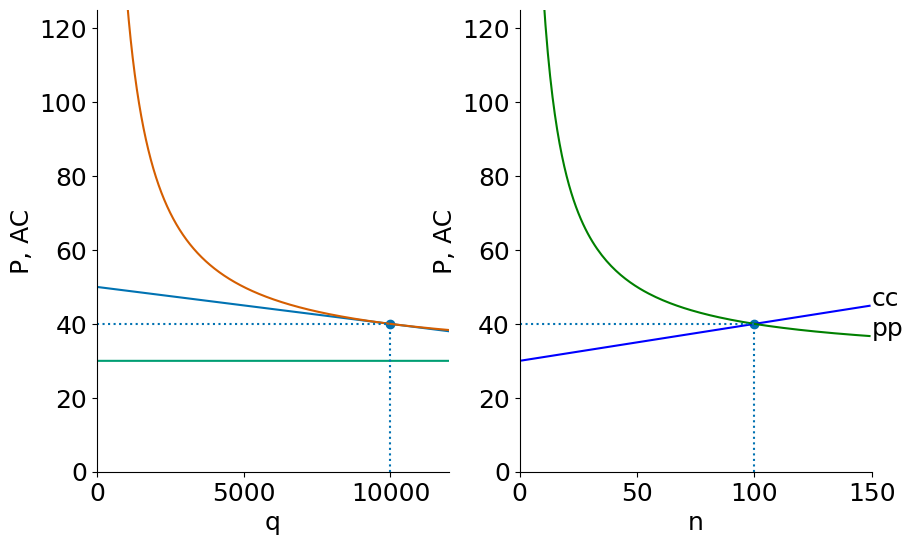

mkt_eq(S,F,c);Here is the country when closed to trade:

twopane(50000,F,c)n = 22, P= 75, q = 2236, F/q = 45

And after the countries open to trade:

twopane(S,F,c)n = 100, P= 40, q = 10000, F/q = 10