Research

New Papers#

Baker, Matthew and Jonathan Conning (2023) A Model of Enclosures: Coordination, Conflict, and Efficiency in the Transformation of Land Property Rights

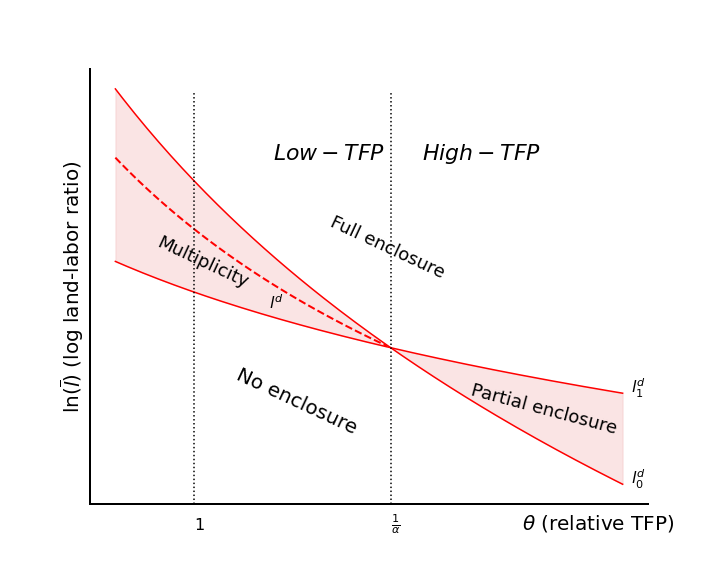

Abstract: Historians and political economists have long debated the processes that led land in frontier regions, managed commons, and a variety of customary landholding regimes to be enclosed and transformed into more exclusive forms of private property. Using the framework of aggregative games, we examine land-holding regimes where access to land is established via possession and use, and then explore the factors that may initiate decentralized privatization processes. Factors including population density, potential for technology improvement, enclosure costs, shifts in group cohesion and bargaining power, or the policy and institutional environment determine the equilibrium mix of property regimes. While decentralized processes yield efficient enclosure and technological transformation in some circumstances, in others, the outcomes fall short of second-best. This stems from the interaction of different spillover effects, leading to inefficiently low rates of enclosure and technological transformation in some cases and excessive enclosure in others. Implementing policies to strengthen customary governance, compensate displaced stakeholders, or subsidize/tax enclosure can realign incentives. However, addressing one market failure while overlooking others can worsen outcomes. Our analysis offers a unified framework for evaluating claimed mechanisms and processes across Neoclassical, neo-institutional, and Marxian interpretations of enclosure processes.

Basu, Karna and Jonathan Conning (2021) Commitments under Threat: Present-Bias, Renegotiation, and Consumer Protection Forms, manuscript, under submission.

Abstract: Hyperbolic discounters value consumption-smoothing commitment contracts, but may fear that these could be renegotiated by future selves and banks. This creates a consumer protection problem even for sophisticated and informed consumers. This paper studies how the threat of renegotiation affects equilibrium commitment contracts and bank governance forms. We find that familiar behaviors such as ‘over’-borrowing or ‘under’-saving emerge, but here as strategic partial concessions to future selves to avoid even costlier renegotiation behaviors later. We then show how it may be to banks’ advantage to offer additional consumer protection either via an appeal for government regulation or through costly private governance/ownership choices. By restricting their own ability to profit from opportunistic renegotiation, banks can expand gains to trade and captured profits. The framework establishes new behavioral micro-foundations for a theory of commercial non-profits and helps explain historical patterns of contracting and ownership forms in consumer banking and microfinance, and how these co-evolved with market structure.